- Antradienis, Gruodžio 9, 2025

When will server RAM prices go down? As of December 2025, not anytime soon. Server memory prices have surged to multi-year highs — and experts say they’re likely to stay elevated through 2026, with meaningful relief only possible by late 2027 or beyond. The reason? A perfect storm: record-breaking AI infrastructure demand, shrinking production of older DRAM like DDR4, a global pivot to higher-margin chips like HBM and DDR5, and the rapid exhaustion of memory inventories. With nearly every type of memory — from DRAM to NAND to SSDs — in short supply, the server market is facing one of the most prolonged and severe shortages in memory history.

Here at Bacloud, we face the same challenge as many in the industry: sourcing RAM at a reasonable price. The server memory market is so volatile that prices can change hourly — some wholesale suppliers now lock in RAM quotes for just one hour, forcing rapid purchasing decisions. It’s not just RAM, either. Other key components have also seen steep price increases: enterprise-grade NVMe drives have more than doubled, and complete Supermicro server systems — including RAM and storage — have increased by up to 70% in recent months.

December 2025 Market Snapshot

-

Skyrocketing prices. Throughout 2024–2025, memory prices have reversed years of declines and soared. By Fall 2025, DRAM spot prices were nearly triple year-ago levels. Even consumer DDR4 and DDR5 kits roughly doubled in cost in the second half of 2025. For example, a 32 GB DDR5 kit rose from approximately $95 in mid-2025 to roughly $184 by October. This surge means server-grade modules are costly right now.

-

Very low inventories. DRAM suppliers’ stockpiles have been drawn down. Average memory inventory has plunged to single-digit weeks of supply – about 8 weeks in late 2025, versus 31 weeks in early 2023. This lack of inventory means buyers can’t rely on surplus chips – they must compete for new output.

-

Seller’s market. Major analysts describe the market as strongly seller-dominated with persistent undersupply. For example, a TrendForce report notes that data center spending is high and servers contain more DRAM per machine than before, so “the overall market is expected to remain seller-dominated with persistent undersupply”. In practical terms, that means memory manufacturers hold the pricing power for now.

-

Contract prices are rising. Industry forecasters (TrendForce/DRAMeXchange) report that server DRAM contract prices rose by 18–23% quarter over quarter in Q4 2025. This was much higher than earlier projections, reflecting buyers scrambling to secure supply. The same analysis expects DDR5 prices to keep climbing through 2026, especially in the first half. In short, prices are going up, not down, in the near term.

-

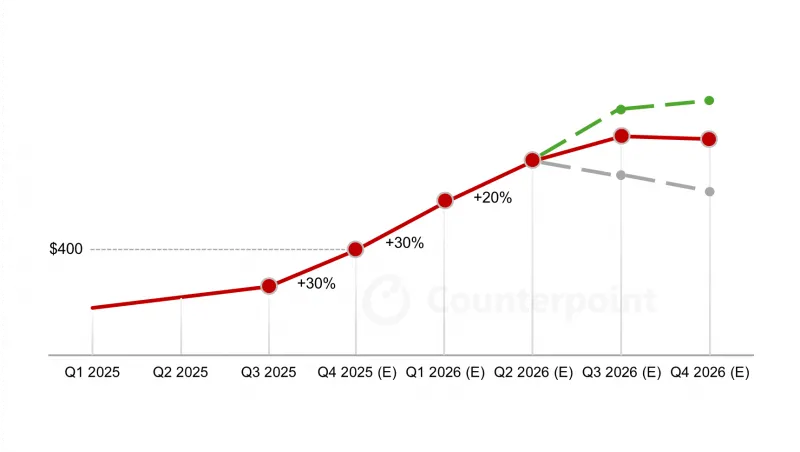

Prices could double by the end of 2026. According to Counterpoint Research, server DRAM prices are on track to double by late 2026. DRAM costs had already climbed roughly 50% in 2025, and analysts now expect an additional 30% surge in late 2025, followed by another 20% in early 2026. The firm forecasts that 64 GB DDR5 RDIMM modules could cost twice as much by the end of 2026 as they did at the start of 2025 — a trajectory driven by structural supply constraints and surging AI-related demand.

DRAM Price Scenario (DDR5 64GB RDIMM)

Counterpoint Research Information

How Manufacturers Are Reacting

Memory makers are reacting carefully: instead of flooding the market, they are mostly holding back capacity to protect pricing. Key players have signaled their strategies as follows:

-

Samsung Electronics – Management has explicitly said it will focus on long-term profitability rather than chasing market share. In practice, Samsung is not aggressively expanding its commodity DRAM capacity. A recent investor call noted that Samsung can fulfill only about 70% of current DRAM orders, as demand far outstrips output. Samsung has also balked at tying up volumes in multi-year contracts; it told customers it does not want to lock in supply at fixed prices when prices are rising rapidly. In other words, Samsung is limiting new production to avoid creating an oversupply bubble, even though customers are demanding chips. Samsung planned to end most DDR4 production by 2025, but it has since reversed course. It still prioritizes DDR5 and HBM lines.

-

SK Hynix – This Korean giant is taking a somewhat more aggressive stance on capacity, but its near-term output is still tight. SK Hynix has been building new fabs (including giga-scale HBM plants) and aims to invest roughly 30% of its revenue in new capacity in 2026, with a fast track to 1a/1b process nodes for DRAM. Despite that, SK acknowledges it cannot meet all demand today: Chey Tae-won, Chairman of SK Group, has said customers are “begging for supply,” and SK is working to boost output but warned that fulfilling all orders will be difficult. Notably, SK admitted that all its DRAM production is already sold out for 2026 – meaning no spot chips left for new buyers – and that only its planned fabs in 2027–28 will add more conventional DRAM capacity. In short, SK is expanding, but its actions remain constrained by the manufacturing timeline; it expects the tightness to ease only when its new 1b/1a lines begin shipping in 2027 and beyond.

-

Micron Technology – Micron has pivoted away from consumer memory (it even ended its Crucial RAM brand) to focus on the data-center market. Like its peers, Micron is redirecting production toward high-value segments (server DRAM and HBM) and away from PCs and phones. The company plans a major new fab in Japan (nearly $10 billion), but it won’t ship any chips until the second half of 2028. In other words, Micron’s next wave of capacity won’t help until very late 2028, so it’s not alleviating near-term supply issues. Management has said that surging AI demand “led to a surge in demand for memory” and thus Micron must serve its largest customers first.

Overall, all three major DRAM producers are holding back expansions for now. Samsung and SK Hynix are “minimizing the risk of oversupply” – essentially deciding to ride out the boom rather than add so much output that prices collapse later. This deliberate caution helps explain why analysts predict that high prices will persist: supply growth is being capped.

What Analysts and Experts Predict

Most industry analysts agree: prices won’t drop meaningfully until at least mid-2026, and probably later. Key forecasts include:

-

TrendForce/DRAMeXchange: Their latest reports (Nov 2025) indicate little relief is in sight. They predict server DRAM contract prices rose ~43–48% QoQ in Q4 2025 and expect further hikes into 2026. DDR4 shortages are expected to persist into the first half of 2026, with contract prices (including HBM) still climbing ~13–18% in Q4 2025. In their view, the mix of AI projects and delayed capacity means memory supply will remain tight through H1 2026. TrendForce also notes that global server shipments may only rise by ~4% in 2026, but each new server will contain significantly more memory for AI workloads, further extending the shortage.

-

Counterpoint Research (via Network World) – Counterpoint’s analysis is similarly grim. It reports that DRAM prices are already up ~50% in 2025, and expects an additional ~30% jump in Q4 2025 and ~20% in early 2026. They forecast DDR5 server module costs will double by late 2026 compared with early 2025. Their analysts note that even a ~20% increase in DRAM production in 2026 will not catch up with AI-driven demand. Counterpoint advises buyers to negotiate skillfully in advance and diversify suppliers, warning that many firms will face fierce competition for chips.

-

TeamGroup (industry executive) – Chen Qing-wen, GM of memory maker TeamGroup, has been vocal. He notes that DRAM/NAND contract prices have already nearly doubled this year and warns that the shortage will worsen in early 2026. Chen projects no price relief through 2026, with shortages easing only in late 2027 or 2028. In his view, this is a structural AI-driven crunch, not a normal cycle.

-

SK Hynix / Industry Outlook – SK Hynix has warned that the shortage could persist into late 2027. Securities analysts in Korea similarly expect DRAM and NAND prices to keep rising for “several more quarters”. Even memory distributors like Silicon Motion’s CEO say all major memory types (DRAM, HBM, NAND, HDD) will be in severe shortage through 2026.

-

TechInsights / Other analysts – Some, like TechInsights, caution that the word “supercycle” is overblown and this is basically a shortage lasting roughly 1–2 years. TechInsights forecasts a general semiconductor downturn by 2027 after this rush. In the “optimistic” scenario, if new fabs come online on time and AI spending moderates, prices could start to stabilize by late 2026 or early 2027. However, most data points suggest that even this more benign scenario implies no price drop before 2027.

Optimistic (Late 2026) vs. Pessimistic (2027–28) Scenarios

-

Optimistic outlook: A few analysts had hoped that by late 2026, the situation might ease. For example, if planned capacity expansions (new fabs) were implemented and AI build-out delays occurred, memory supply could catch up. In this view, prices might flatten or inch downward by late 2026. TechInsights, for instance, suggests the industry is in a classic short-term shortage that could turn by 2027. In this best-case scenario, server RAM prices might start to level off in the second half of 2026, staying high but not climbing further.

-

Pessimistic outlook: The most likely outcome is continued tightness through 2027–28. Most forecasts have been repeatedly pushed back: TeamGroup and TrendForce now see the crunch lasting through late 2027, and PC-focused analyses indicate stabilization may not arrive until 2028 or later. Samsung and SK Hynix’s strategy of avoiding significant capacity increases implies there will be no price collapse – possibly not even a softening – until the AI boom itself fades or gets interrupted. In essence, unless a dramatic demand shock occurs (e.g., an abrupt slowdown in AI spending), the broad expectation is that server RAM will remain expensive through 2027.

What Should Buyers Do in 2026?

Given this outlook, businesses and IT departments should plan carefully:

-

Lock in supply early: If you need new servers or memory upgrades, try to secure contracts or long-term supply agreements now. Many large customers are already negotiating 2–3 year deals with memory suppliers. As Counterpoint’s analysts advise, companies should “lock in supply and costs in advance” if possible. Having some guaranteed allocation helps avoid getting shut out in a short market.

-

Budget for higher costs: Expect to pay significantly more per GB than in 2024–25. Model your costs with current memory prices, not old norms. For cloud or hosted servers, note that providers may face cost pressures as well.

-

Phase purchases to average pricing: Smaller customers without big leverage can mitigate pain by spreading out purchases over time. In practice, that means buying just enough memory now and deferring the rest, so that if prices rise further, only a portion of your project is affected. Conversely, if prices do start falling in late 2026, you can catch the dip on the remaining orders.

-

Consider technology choices: DDR5 and especially HBM are in short supply, whereas older DDR4 may see more volatility (it briefly caught up in price). If your workloads allow, flexibility in memory type (e.g., using LPDDR5X or other platforms) could help. However, most analysts note that all DRAM types are in short supply, so that savings will be limited.

-

Evaluate alternatives: Some firms may consider sourcing memory from emerging suppliers (e.g., Chinese DDR4 makers such as CXMT) or through secondhand/server market channels. Be cautious: these routes can be unpredictable and may have compatibility or certification challenges. Relay on tier-1 partners (Samsung, SK Hynix, Micron) for critical infrastructure.

-

Delay non-essential upgrades if feasible: If you can postpone planned server expansions until later in 2026 (or even 2027), you might get slightly better pricing. However, industry consensus is that conditions will not noticeably improve until late 2026 or 2027. TechRadar notes that 2027–28 is likely the earliest time when RAM prices normalize. Thus, for any non-urgent projects, consider whether they can wait.

-

Please monitor manufacturer news and market reports. If new fabs or shifts in demand occur unexpectedly, the outlook could change. But given current industry statements (Samsung not expanding, SK selling out 2026 production, Micron’s fab only online 2028), the trend for 2026 is almost certainly upward or flat, not downward.

Summary

In summary, server RAM prices are at a multi-year high as of late 2025, and all signs point to continued tight supply into 2026. The main drivers are explosive AI-related demand and manufacturers’ focus on HBM/DDR5 over older DRAM. Industry forecasts uniformly caution that there will be no quick relief. Even the most optimistic scenario only eases prices by late 2026 (with normalization likely in 2027), while the pessimistic view pushes real recovery to 2028 or later.

What this means for buyers: Plan on high DRAM costs throughout 2026. If you need server memory, please consider securing supply now, adjust budgets accordingly, and explore options to reduce timing risk. For most organizations, the practical advice is to expect higher prices next year and to make purchasing decisions accordingly.