The past year has seen an unprecedented surge in RAM prices, with high-end DDR5 memory costs skyrocketing and supply tightening across the industry. As of January 2026, memory prices remain near record highs, and experts predict relief may not come for quite some time. Below, we summarize the current RAM price situation, why it’s happening, and when we might finally see prices come down

Soaring RAM Prices Heading into 2026

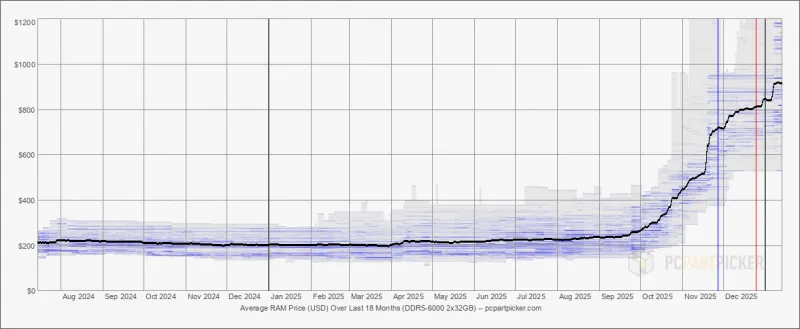

Average DDR5 memory prices (for a 64GB kit) spiked dramatically in late 2025. A long period of stable pricing around $200 was shattered as costs shot up to $800–$900 by the end of 2025. In the final quarter of 2025, DRAM prices exploded. Industry tracking shows that between October and December 2025, the average price for a 64GB high-end DDR5 kit (2×32 GB) jumped from just over $200 to around $800, and similar kits even hit $900 on average by year’s end. In other words, memory that cost a couple of hundred dollars in mid-2025 ended up costing four times as much just a few months later. For example, one popular 32GB DDR5-6000 kit that was £79 in September 2025 soared to £351 by January 2026, a staggering 344% increase. These kinds of price hikes are virtually unheard of in the consumer PC space and have made RAM upgrades prohibitively expensive for many.

Pcpartpicker.com market trends

The good news is that the rapid weekly price climbs have finally slowed down as we entered 2026. After the near-vertical rise in Q4 2025, prices seem to have plateaued in early 2026 – but at extremely high levels. A 64GB DDR5 memory kit now averages about $900, and it appears buyers are simply refusing to pay more, putting a ceiling on further increases. In effect, demand has cooled at these prices, creating a temporary stabilization. However, this doesn’t mean memory is getting cheaper – it’s just not getting even more expensive week after week as it was in late 2025.

It’s worth noting that this crunch isn’t limited to consumer RAM sticks. Enterprise and data-center memory modules have been hit even harder. Higher-capacity server DIMMs (used in servers and workstations) now cost small fortunes – in early 2026, we’ve seen quotes near $2,000–$4,000 for a single high-end DDR5 module, depending on capacity. Even fairly standard 8GB or 16GB modules that used to be commodity items have doubled or tripled in price. For instance, an 8GB DDR4 laptop module can cost around $60 now (up from maybe $20 a year prior), and a 32GB DDR5 laptop SO-DIMM is in the few-hundred-dollar range. In short, all tiers of the memory market – from basic consumer sticks to top-tier server RAM – are feeling the squeeze.

Why Did RAM Prices Skyrocket?

In brief, the current price crisis is driven by a perfect storm of supply and demand factors – notably the surging demand from AI (artificial intelligence) applications and deliberate supply constraints by manufacturers. Throughout 2025, the explosion of generative AI workloads led data centers to gobble up memory chips at unprecedented rates. AI servers require vast amounts of RAM, and the big memory manufacturers (Samsung, SK Hynix, and Micron) have redirected much of their production capacity toward higher-margin AI memory like HBM (high-bandwidth memory) and high-capacity server DDR5. Every wafer of silicon that gets used for an HBM stack (for an Nvidia AI accelerator, for example) is a wafer not used to make standard PC DRAM – and this shift has drastically tightened the supply of general-purpose memory chips.

At the same time, manufacturers have been very cautious not to over-produce. Coming off a downturn in previous years, the memory makers have kept output in check (“output controls”) to avoid another glut, even as demand now spikes. This disciplined approach means they are in no rush to flood the market to drive prices down. In fact, as one industry analysis noted, this is not a normal boom-bust cycle but a structural reallocation of capacity – the priority is on AI and enterprise memory, and consumer PC RAM is taking a back seat. The result is a classic supply-demand imbalance: not enough chips for everyone, so prices shoot up across the board.

Other factors have added to the crunch as well. The final phase-out of DDR4 production in favor of DDR5 created some weird market dynamics, with older DDR4 modules becoming scarce (and sometimes more expensive than DDR5) due to legacy demand. This forced many system builders to migrate fully to DDR5 earlier than planned, further increasing DDR5 demand when supply was already limited. On top of that, the general semiconductor supply chain is still dealing with limited fab expansion and long lead times for new facilities to come online. All these pressures combined in late 2025 to create the “perfect storm” for a memory shortage, driving prices into the stratosphere.

When Will RAM Prices Go Down?

With RAM modules now as costly as high-end CPUs or GPUs, the obvious question is: when can we expect prices to come back to Earth? Unfortunately, the consensus from market observers is grim – don’t expect meaningful price relief in the immediate future. 2026 is likely to be another year of expensive memory, and it could be 2027 or later before the market corrects in any significant way.

Industry forecasts suggest DRAM prices will remain high throughout 2026 (continuing to rise in the first half, driven by AI demand), with only a potential easing or plateau by late 2026. A significant drop or “return to normal” pricing isn’t anticipated until 2027 or beyond, when new production capacity finally catches up.

In the near term (early-to-mid 2026), analysts actually expect memory prices to keep climbing, albeit at a more moderate pace than the frantic Q4 2025 spike. Market research firm TrendForce, for example, forecasts that contract prices for DRAM will jump roughly 55–60% in just the first quarter of 2026 compared to late 2025. (In fact, major server buyers have already been warned to brace for another ~60% surge in server RAM prices in Q1.) The first half of 2026 is projected to see continued tight supply and rising costs – effectively, the shortage gets worse before it gets better. One tech news outlet put it bluntly: DDR5 pricing “won’t return to normal in 2026” and could even worsen in the short term as AI mega-buyers continue to absorb most of the supply. In other words, anyone hoping that the new year would bring a quick reversal in RAM prices will be disappointed.

Later in 2026, we might see the situation stabilize somewhat. A few new semiconductor fabrication projects are coming online, which could gradually improve supply. For instance, Samsung’s new Pyeongtaek “P4” fab is slated to ramp up DRAM production through 2026, and SK Hynix’s M15X fab is set to start production (focused on advanced memory) around the same timeframe. These additions will gradually increase the global memory supply. By late 2026, the hope is that supply and demand will at least reach a plateau, stopping the upward price spiral. Indeed, some experts predict a price plateau by the end of 2026 – essentially a period of price stability once the new fabs make a dent – but not an outright decline. The reality is that it takes time for new factories to ramp up and for inventory to flow down to the market.

The more meaningful price drops aren’t expected until 2027 (barring a sudden collapse in demand). Memory industry analysts suggest that only in late 2027 might we see a significant downward correction in RAM prices. By that time, multiple new fabs (including some of Micron’s planned expansions, though those may not fully arrive until 2028) should be contributing, and the current AI-driven demand frenzy could level off or be met with sufficient supply. In short, the high prices are here to stay through 2026, and possibly into 2027. The situation could, of course, change – for example, if the AI boom cooled unexpectedly or if manufacturers changed strategy – but planning assumptions right now should assume no big price relief this year.

Industry Insight and Planning Ahead

The views of hardware suppliers and distributors on the ground corroborate these forecasts. At Bacloud, where we source components for servers and infrastructure, we’ve been closely monitoring the market through our partners. The word we’re getting is that neither memory nor NVMe storage pricing will improve in the near term. Manufacturers are keeping output constrained and allocating supply very selectively. In fact, visibility into future stock is shrinking – suppliers can’t even guarantee availability a few months out for certain enterprise-grade products, which is a sign of how tight things are. High-end enterprise and data center SKUs (both RAM and SSDs) are particularly affected. If you need, say, a batch of high-capacity DDR5 ECC modules or PCIe 4.0 NVMe drives, you may face long lead times or vendor allocations (rationing). It’s a classic shortage scenario: not only are prices high, but sometimes you simply can’t get the item in the spec you want, no matter the price.

This aligns with what the broader tech market is seeing. Memory makers are prioritizing lucrative server and AI customers, and even NAND Flash (for SSDs) is now feeling the squeeze alongside DRAM. Recent estimates indicate NAND flash contract prices will rise ~33–38% QoQ in Q1 2026 due to tight supply, and client SSD prices could jump 40% or more in the short term. So, the pain isn’t limited to RAM sticks – your solid-state drives are getting more expensive too.

What can businesses and consumers do in this environment? Here are a few key takeaways and tips to navigate the memory shortage in 2026:

-

Plan and purchase early: If you know you’ll need more memory in the coming quarter or for a future project, secure it as soon as possible. Prices are expected to be even higher later on, so buying earlier could save you money (and ensure you have stock on hand). Waiting in hopes of a price drop is likely a losing strategy this year.

-

Standardize on DDR5 (newer platforms): For new system builds or upgrades, it’s wise to move to DDR5 if you haven’t already. DDR4 is being phased out and, in some cases, has become surprisingly expensive due to low supply. Modern CPU platforms (Intel 12th/13th-gen, AMD AM5, etc.) use DDR5, and sticking with the current standard ensures better availability long-term. (Older DDR4 modules might seem “cheaper” in theory, but they won’t stay that way if production has largely stopped.)

-

Budget for pricier PCs/servers: Whether you’re a gamer building a rig or a company buying servers, expect overall system prices to be higher because of expensive memory. OEMs and PC manufacturers are facing 15–20% higher RAM costs, which will be passed along in the prices of laptops, desktops, and servers. Don’t be shocked if a new PC model comes with less RAM than last year’s or at a higher price point – it’s an industry-wide trend.

-

Work with trusted suppliers and plan for lead times: In a scarce market, having a reliable vendor is crucial. Last-minute spot market buys can be risky – you might encounter exorbitant prices or even counterfeit products. It’s safer to stick with authorized distributors or reputable providers (like Bacloud and our partners) that can provide real-time pricing, genuine parts, and honest lead-time estimates. Communicate your upcoming needs and, if possible, lock in orders in advance. This helps avoid scrambling when a critical upgrade or deployment is due.

On our end, we at Bacloud will continue to closely monitor the memory and storage situation. We update our website regularly with current pricing for RAM and NVMe drives, so you can check there for the latest figures. If you’re unsure about what to do for an upcoming project – for example, whether to buy now or wait, or which memory capacity to choose – feel free to reach out to us. We’re happy to share more detailed insights by specific capacity, form factor, or timing, and help our clients sanity-check their requirements against market realities. The bottom line is that 2026 is a challenging year for memory buyers, but with careful planning and the right partnerships, you can navigate the turbulence and avoid unpleasant surprises, such as mid-project price spikes or component shortages.

Final Thoughts

The RAM price spike of 2025–2026 is a rare event that has reminded everyone in the tech world how supply chains can dramatically impact costs. While it’s painful to pay 3–4× more for the same memory, understanding why this is happening – and knowing that it’s a global issue driven by voracious AI demand and limited supply – can help us make informed decisions. In summary, expect high memory prices to persist through 2026, plan your purchases accordingly, and keep an eye on industry updates. We’ll be watching how this unfolds, and we remain hopeful that by 2027 the market will rebalance and bring some relief. Until then, consider your RAM upgrades carefully, and treat those DIMMs like the precious commodities they’ve become!